Determining the True Fit and True Value of Your Acquisitions

Law firm acquisitions and mergers are complex, time-consuming and very expensive if they fail.

Like lateral hires, failure rates for law firm acquisitions and mergers hover around 50%.

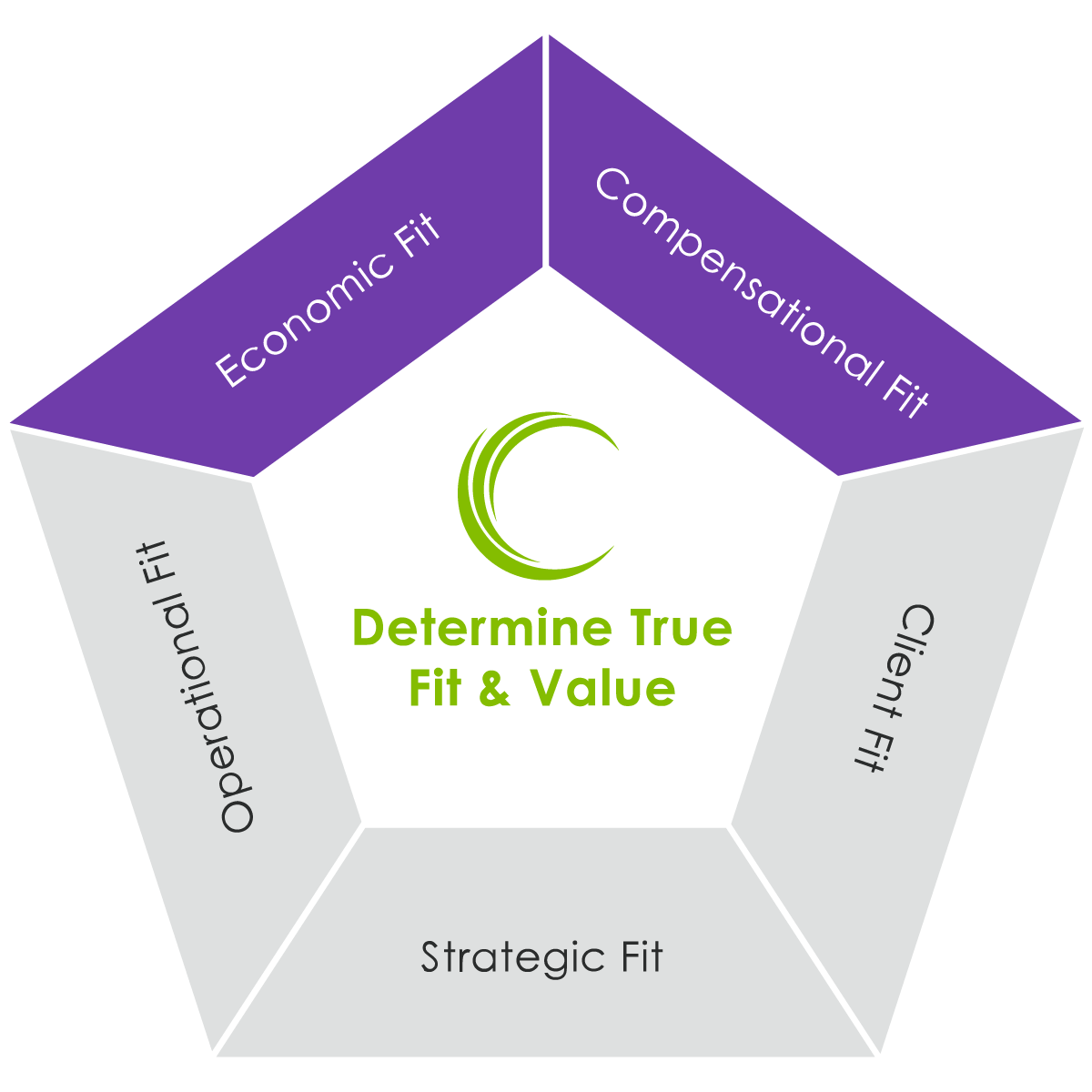

These failures can almost always be traced to a bad “fit” in one or more key areas: strategic, cultural, operational, economic or client. Or, the true value of the acquired firm was not accurate.

Conducting smart, robust and “information rich” due diligence is essential to success.

How We Work

Before you decide to commit the resources to a full due diligence effort, you need to know if there is a basic fit between your firm and the target firm. If not, move on.

If there is a basic fit, Concata forms a due diligence team with members from your firm. Our shared goal is to ascertain the “true fit” and “true value” of the target.

Your team members — using a combination of our tools and any you may have developed — conduct the strategic, cultural, operational and client analysis.

Concata conducts the economic and compensation diligence. We also use the financial data to determine the true value of the target firm.

The team summarizes this information into a “target fit” profile that you, the management committee and the partnership can use to debate the merits of the target and come to an informed decision as to whether you should complete the deal.